Key Business Trends for 2022:

The world is changing fast and businesses are having to adapt accordingly.

Businesses across the world have been grappling with rapid transformation because of changes to working practices, shifts in buyer behaviour and ongoing economic uncertainty.

The way we work is evolving

In the last 18months, the shift to agile or flexible working has been accelerated by the pandemic. In 2022 the way we work will continue to evolve. Gig workers, remote workers and a move away from the traditional model of employment look set to be themes that will continue to evolve into 2022 and beyond.

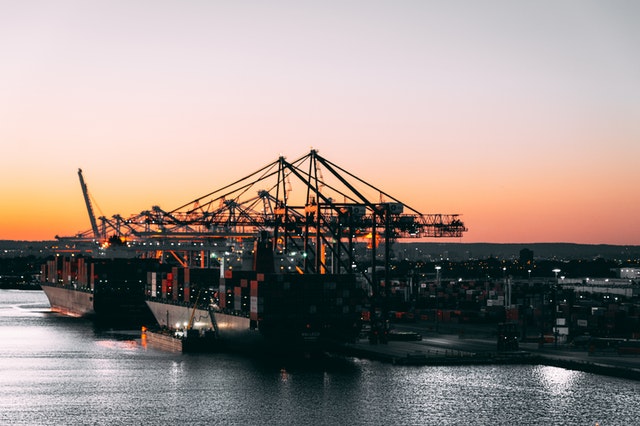

Sustainability

All businesses must seek to reduce their environmental impact. Some businesses are trying to reduce the amount of waste that they produce, while others are setting lofty objectives to decarbonize their supply chains. Any business that ignores sustainability and the green agenda is unlikely to do well in the new age of conscious consumption.

Communication using apps

The pandemic has shifted commerce online and away from bricks and mortar / in-person meetings. In addition to telephone calls or emails, customers now expect businesses to be able to communicate using popular apps such as WhatsApp, Teams, Zoom or Skype. This trend is likely to continue post pandemic.

Virtual events

Meetings have moved online for many businesses and so have events. Whether it’s launching a new product or service on a livestream video or hosting a webinar, virtual events are here to stay. Physical, in-person conferences and events may return after the pandemic, but virtual events eliminate the need to travel so are time efficient and less costly to attend or to run.

Social media marketing

When was the last time you looked at an advert on television or a billboard outside? Now that we spend more of our time online and connecting through social media, businesses have responded by focusing their marketing budgets on online campaigns. Social media marketing is not just for large, global businesses – small and medium sized businesses can use social media campaigns to create targeted, local campaigns with data-driven analytics which help to zone in on specific types of clients and prospects. Buyer behaviours have shifted – people now buy more online than ever before, so it makes sense that businesses are shifting their marketing focus to the online platforms that people are now using.

Need more information?

Are you wanting to evolve in 2022. Our key business trends will help you think about how you do business in the future. We offer a wide range of services which are unique to your business. Our team of chartered accountants have a wealth of experience in a broad range of sectors, from construction and property to the charity sector. Our team work hard to ensure they create smart and effective tax-efficient solutions for start-ups to optimise growth and help them succeed. If you want to learn more about how the team can help or simply want some start-up advice from a trusted accountant do hesitate to contact us. For more information please do hesitate to contact us on 0161 962 1855. Alternatively you can email us using the form below and we will contact you as soon as possible.

Our fantastic team at A&C Chartered Accountants are here to help.