Co-Construct is all about helping you to make the right decisions on time, every time. The Co-Construct software helps to keep your selections process fund and extremely simple whilst maintaining complete flexibility for your clients. This awesome software will help you to bring order to selection chaos without affecting your creative flow. It will help to you clearly display specifications, pricing and files that both your own team and your clients will find extremely easy to navigate through.

If you are familiar with change orders then Co-Construct will allow you to create them painlessly which gives you the freedom to turn selection overages into change orders or even create news ones at the click of a mouse. Secure signoffs within the software allow the projects to move along at a good pace and regardless of your financial structure client can see a real time snapshot when and where they want.

Add to that the fact that Co-Construct has some excellent communication features which allow you to keep up to the date news and communication with your team and clients whether it be via web, mobile, or text for example.

Are you involved with the sales pipeline or lead management? Well Co-Construct can even help you with that. It allows you to grow your business by giving your team control and allowing them to track and manage leads in real time. You can focus on your hot prospects by adding categories and scoring factors or alternatively why not integrate task lists which give you a breakdown of what is expected day by day whether it be leads field tasks or other tiresome admin tasks.

The scheduling feature is particularly impressive as it allows you to run your company and not just a project giving you the power to manage all of your activities and projects company wide.. Co-Construct supplies ready made schedule templates or alternatively you can build your own if that is your preference.

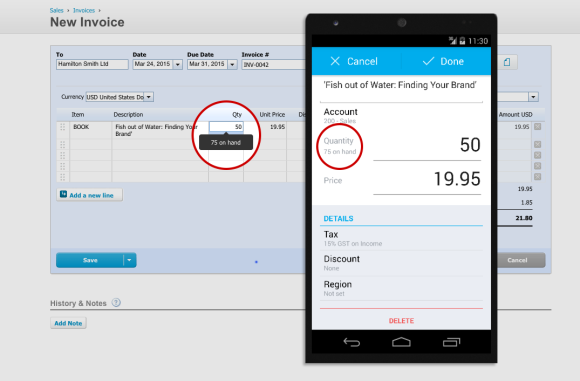

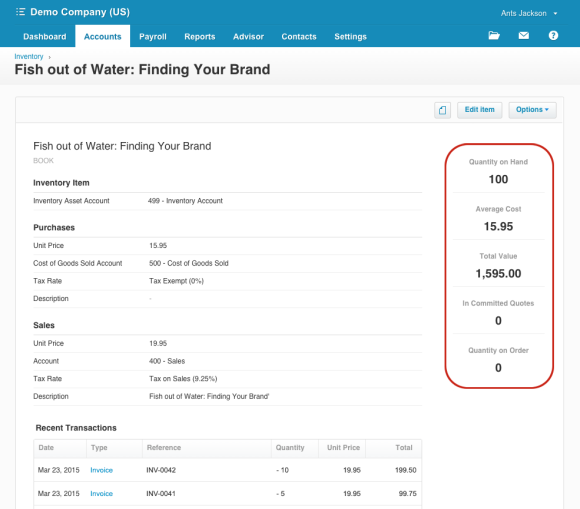

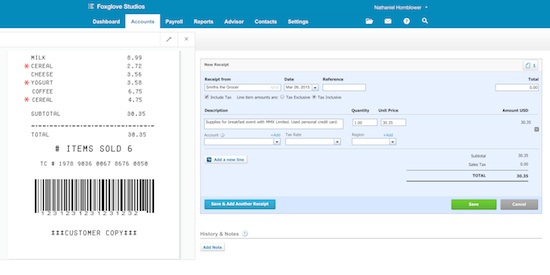

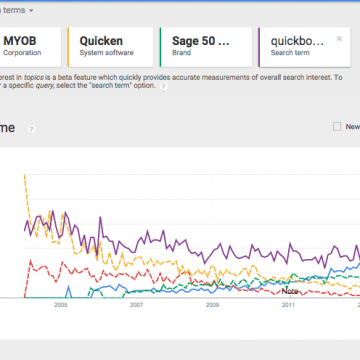

Co-Construct is a fully web based and mobile construction project management software which has been fully designed to satisfy the needs of clients, builders and design build firms involved within the construction industry. This powerful software offers a vast array of feature rich solutions to assist with the remodelling or building of your new / existing home. Co-Construct will help you with budget planning, warranty management and fully allows integration with Xero which is a cloud based accounting software to give you the complete suite of tools to allow your business to run simpler and smarter.

Just by reading through the above information you can hopefully start to see exactly how by using Co-Construct and Xero it allows you to concentrate and focus fully on more client facing work, which will also remove the hassles that come with the administration side of the business.

If you would like to learn more about Co-Construct, what it has to offer and the integration abilities we would love for you to contact us on 0161 962 1855 for a free and informal chat with a member of our cloud accounting team.