Important Tax Deadlines & Events (Updated For 2025)

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

Discover the suggested reimbursement rates for employees’ private mileage using their company car.

Now is the perfect time to review your finances and make sure you’re making the most of available tax reliefs and allowances.

It is that time of year again for staff parties and annual functions, so it is important to make sure you record it properly.

This alternative to the classic management buy-out enables the shareholders of a trading company to sell their shares free of CGT to a trust set up for the benefit of the employees.

If you do not wish to sell your business but are looking to reduce your involvement, you may be considering passing on your business to the next generation, or maybe your management team.

Now that the economy is starting to recover, this could be a good time to think about selling your business. Remember that under the current capital gains rules, the first £1 million of an individual’s gains potentially qualify for a 10% rate of tax, provided business asset disposal relief applies. We can check whether or not you and other business owners qualify for this generous relief. Note that the £1 million limit applies to all disposals during an individual’s lifetime

A new, and arguably fairer, system for determining penalties for late returns and late payment of VAT was due to be introduced from April 2022. However, it has been recently announced that the start has been delayed until January 2023. The same system will also apply to returns under MTD for income tax and those penalties will now start in April 2024

If your family are not interested in taking over your business, have you considered selling the business to your management team?

You now have longer to pay personal tax. 2020/21 income tax, CGT, class 2 and 4 NIC liabilities normally need to be paid by 31 January 2022. However, HMRC have recently announced that provided the tax is paid by 1 April 2022, there will be no penalty, although interest accrues from 1 February 2022 at 2.75%.

on 23 December 2021, the Chancellor of the Exchequer, Rishi Sunak, commissioned the Office for Budget Responsibility (OBR) to produce an economic and fiscal forecast for Wednesday 23 March 2022.

Businesses across the world have been grappling with rapid transformation because of changes to working practices, shifts in buyer behaviour and ongoing economic uncertainty.

Top of the new year to do list for many individuals is to make or update their will. Many think this is something to leave until later in life, but it is important to get things in place once property is acquired or when children come along.

If your tax payment due on 31 January is more than you expected there is still time to reduce the liability if you are prepared to take a risk.

In the run up to the Autumn Budget many were predicting that the chancellor might announce restrictions to pension tax relief. Thankfully nothing has changed -yet.

At this time of year, we think about New Year’s resolutions. It is also a good time to start planning your

130% super-deduction for investing in new plant continues: Many businesses may have been too short of cash to take advantage of the new super-deduction for investing in new plant in 2021 but may be more confident about investing in 2022.

Second hand plant and machinery does not qualify for the 130% super-deduction but would still qualify for the 100% Annual Investment Allowance (AIA).

In his Spring 2021 Budget the Chancellor announced that there would be 8 “Freeports” in England with generous tax breaks to encourage businesses to set up and invest in those areas.

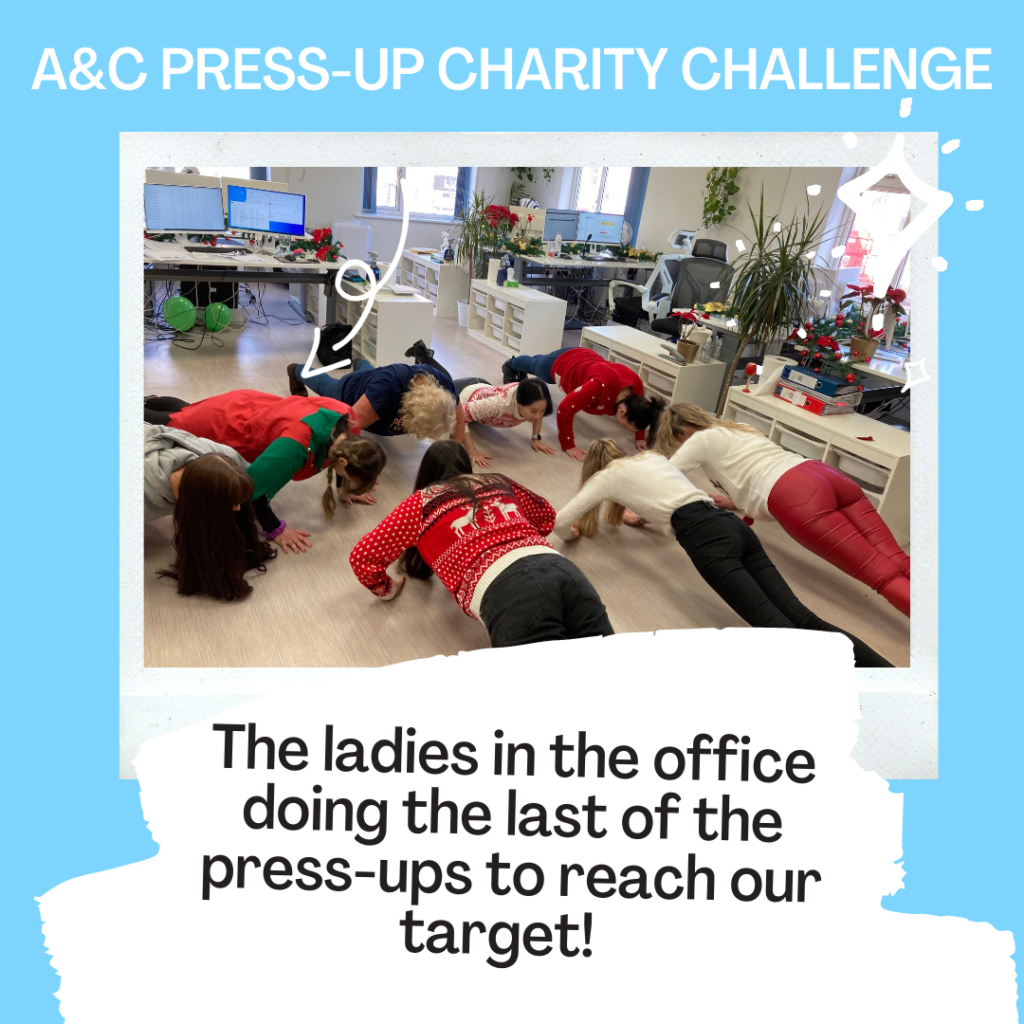

Firstly, we would like to say a big thank you to all clients for your donations so far. We are delighted to confirm we have now completed our 20,000 press-ups for Royal Manchester Children’s Hospital and we are so close to reaching our target of £3000!

A&C’s Christmas Jumper day has been a great success! The team at A&C Chartered Accountants have had a fantastic day on 10th December 2021, to help raise money for the Royal Manchester Children’s Hospital Charity

The latest version of the CT600 Corporation Tax Return requires companies to report CJRS furlough payments received and the amounts

Another tax planning strategy that is still available despite rumours that it would be closed in the Budget was the CGT hold over relief when assets are transferred into or out of a trust.

One tax planning opportunity that many thought the chancellor might restrict was the exemption from inheritance tax for regular gifts out of an individual’s income.

Many were expecting the chancellor to announce changes to inheritance tax (IHT) in his Autumn Budget, However, like capital gains tax (CGT),