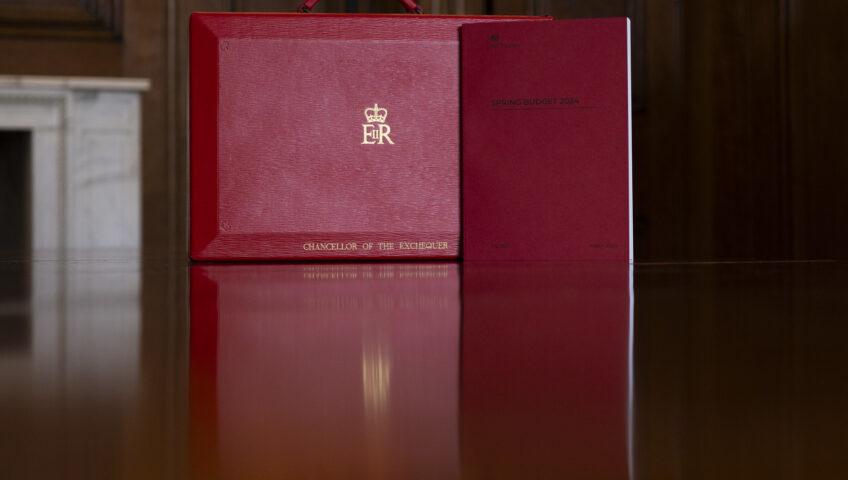

As announced in the Spring Budget, the beneficial tax treatment of furnished holiday lettings (FHLs) will be abolished from 6 April 2025, when the business will start being taxed in the same way as other residential property businesses.

Owners of properties that currently qualify as FHL might wish to consider increasing their expenditure on equipment such as furniture and televisions whilst the 100% annual investment allowance (AIA) continues to be available. The current capital gains tax reliefs, particularly business asset disposal relief (BADR) will also cease from 6 April 2025, so owners might consider selling their holiday letting property whilst the 10% CGT rate continues to apply to the disposal.

Note that where several FHL properties are owned they would all need to be disposed of before 6 April 2025 for BADR to apply. BADR would generally not apply where a single asset is disposed of out of a larger business.

CAMPING PODS MAY QUALIFY FOR CAPITAL ALLOWANCES

A recent case before the First Tier Tribunal will be of interest to businesses operating campsites and also farmers who have diversified into “glamping” by installing camping pods on their land. The capital allowances legislation states that caravans provided mainly for holiday lettings and buildings intended to be moved for the purposes of the qualifying activity, such as building site portacabins, qualify as plant and machinery.

In the recent case the Tribunal determined that certain camping pods which were not connected to mains drainage qualified as plant as they were potentially moveable buildings. This means that where a limited company incurs expenditure on new pods, the 100% AIA and “full expensing” relief would be available and 100% AIA would be available in the case of an unincorporated business.

HMRC may be appealing the decision of the Tribunal, but in the meantime it would be beneficial to make a claim for tax relief and we can review your circumstances to see if they are similar to this recent case.

Need more information?

We offer a wide range of services which are unique to your businesses who are just getting going! Our team of chartered accountants have a wealth of experience in a broad range of sectors, from construction and property to the charity sector. Our team work hard to ensure they create smart and effective tax-efficient solutions for start-ups to optimise growth and help them succeed. If you want to learn more about how the team can help or simply want some start-up advice from a trusted accountant do hesitate to contact us. For more information please do hesitate to contact us on 0161 962 1855. Alternatively you can email us using the form below and we will contact you as soon as possible.

Our fantastic team at A&C Chartered Accountants are here to help.