XERO forge ahead with UK growth plan through 2015, aiming for USA stock listing at the start of 2016

New Xero President Russell Fujioka: U.S. Market Will Be “Biggest”

XERO, one of the worlds fastest growing cloud accounting systems (see global growth trends) predict a surge in UK business throughout 2015. With eyes firmly set on a US stock listing for start of 2016 following massively capital injection of $111 million alongside formidable new leadership team.

XERO, one of the worlds fastest growing cloud accounting systems (see global growth trends) predict a surge in UK business throughout 2015. With eyes firmly set on a US stock listing for start of 2016 following massively capital injection of $111 million alongside formidable new leadership team.

“The primary thing is to get our new U.S. leadership team to do two or three quarters (with the company), so the earliest we would go now is early next year. But there’s no hurry,”

Xero CEO Rod Drury told Reuters in an interview on Wednesday

XERO has had an exciting start to the year already, with bringing on board a number of top executives such as Russell Fujioka (Fujioka most recently worked as a consultant for Xero with global venture capital firm Bessemer Venture Partners), and other critical hires in the past three months includeJames Maiocco (General Manager, Business and Corporate Development U.S & U.K), John Forrester (Vice President, U.S. Marketing), and Greg Volm (Vice President, U.S. Sales).

XERO shares traded at NZ$24.15 ($18) on Wednesday, after rallying to a five-month high of NZ$25.25 last week. The stock has climbed nearly 50 percent so far this year. XERO (XRO.AX) is currently listed in Australia and New Zealand and has a total of 400,000 subscribers covering the United Kingdom, United States of America, Australia and New Zealand, totalling a revenue of NZ$54.3 million in the 6 months to September. according to the company’s fiscal year 2015 report, Xero had 119,000 paying customers in New Zealand, 158,000 in Australia and 22,000 in North America as of September 2014

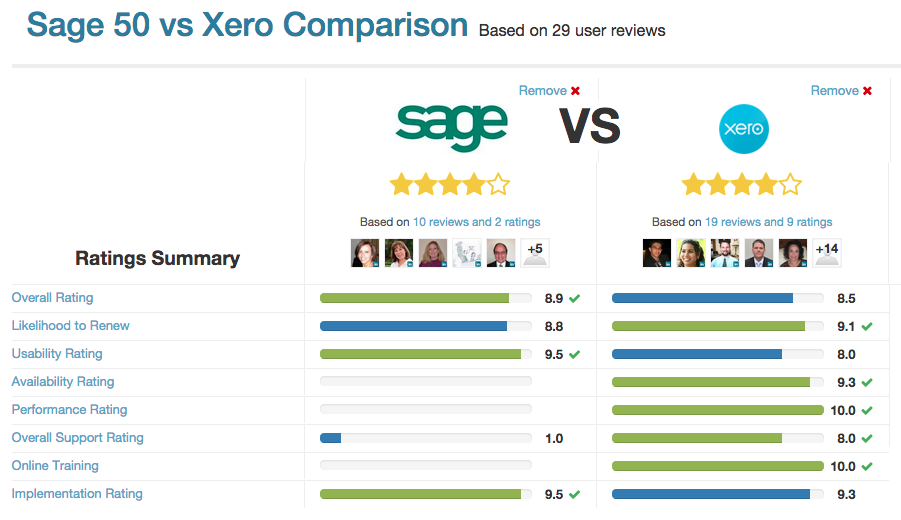

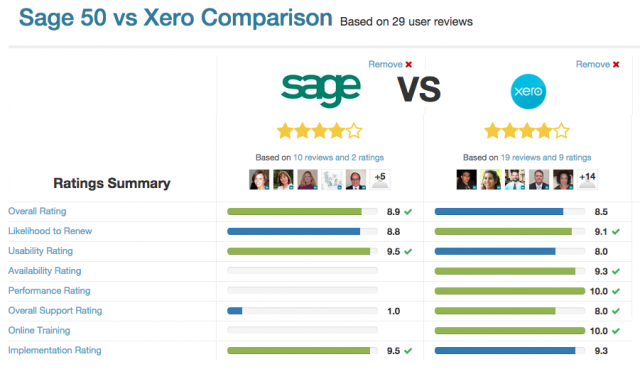

Without a shadow of a doubt, XERO has taken the pole position in the UK overtaking SAGE (SGE.L) in popularity as shown here via Google. XERO certainly is competing fiercely with local Australian competitor MYOB, who intends to list this year.

CEO Rod Drury believes XERO will be able to DOUBLE their UK market share throughout 2015, comprising currently 15% of annual revenue, to 30% whilst making serious inroads into the USA market which is currently dominated by INUIT Quick Books cloud accounting.

CEO Rod Drury believes XERO will be able to DOUBLE their UK market share throughout 2015, comprising currently 15% of annual revenue, to 30% whilst making serious inroads into the USA market which is currently dominated by INUIT Quick Books cloud accounting.

According to XERO CEO Drury, the USA has been a tough market to crack so far, and pins the initial resistance on the accounting firms hesitant to move over to true cloud accounting for their practice and their clients. Moving forward XERO believe they are now in an excellent US position and ready for expansion.

“I have the opportunity to come in and look at things from a non-historical bent as we go forward,”

Fujioka (@russfujioka) shared.

“I’ve had the realization of a couple of things. The business Xero was able to grow, to thrive in New Zealand and Australia, is not a model that is going to work in the U.S. That was primarily through accountants, bookkeepers and CPAs. There is a different way to convert people under the Xero platform.”

The US strategy will certainly be aimed at targeting the small business directly due to the nuances of the US’s 50 states and lagging adoption of cloud accounting practices.

“The central mission of the company is to strive to create a platform that helps small businesses thrive,”

Fujioka said.

“Accountants, CPAs and bookkeepers are a very important part of that. A financial platform like Xero, and particularly Xero, ties into the professional services of a CPA or accountant and the businesses have a higher predisposition to succeed.”

Also giving these businesses a leg up, according to Fujioka, is the foundational community of more than 29 million fellow small businesses.

“Any archetype for the heart of small businesses, the U.S. is the fabric of it,” he said, stressing the company mission “to help small businesses and be material, in the global view, to get the U.S. healthy on Xero and for small businesses.”

Cloud Accounting – An Integral Part Of Business Success

Just take a look at some of our client testimonials. We believe that what we can offer as a cloud accounting practice to the new start business, as well as existing business, is something that is truly revolutionary. Here at A&C Chartered Accountants we understand what is needed to perform in business these days. With so many of us used to working in the cloud in our personal lives, it seems bizarre not to have the flexibility of 24/7 bookkeeping, payroll and accounting also in line with how you’re currently doing business in other areas, as well as outside of the office.