Why should accounting and tax professionals take a walk in the cloud

Most of us generally make use of ‘the cloud’ in our daily personal lives. From streaming music or movies, or accessing emails or sharing photo’s we’re very much deeply engaged in accessing and using cloud technology each and every day. Most of us don’t think twice about using a mobile device (phone or tablet) for many completing so many tasks – even online shopping. It is this introduction of cloud computing technology that has totally shifted the global consumer market in both behaviour and expectations.

Most of us generally make use of ‘the cloud’ in our daily personal lives. From streaming music or movies, or accessing emails or sharing photo’s we’re very much deeply engaged in accessing and using cloud technology each and every day. Most of us don’t think twice about using a mobile device (phone or tablet) for many completing so many tasks – even online shopping. It is this introduction of cloud computing technology that has totally shifted the global consumer market in both behaviour and expectations.

Cloud Accounting

According to a 2014 survey by Network Management Group Inc. and Insight Research Group, 41 percent of professional accounting firms reported that they were not currently using any services or applications that could be defined as cloud computing, with 31.7 percent saying they are likely to implement a Web-hosted or cloud-based version of one or more of their firm’s tax and accounting applications over the next two years. But is that enough? Is the sector of accounting seriously falling behind while the world moves on and demands true cloud accounting power? We believe so…

According to a 2014 survey by Network Management Group Inc. and Insight Research Group, 41 percent of professional accounting firms reported that they were not currently using any services or applications that could be defined as cloud computing, with 31.7 percent saying they are likely to implement a Web-hosted or cloud-based version of one or more of their firm’s tax and accounting applications over the next two years. But is that enough? Is the sector of accounting seriously falling behind while the world moves on and demands true cloud accounting power? We believe so…

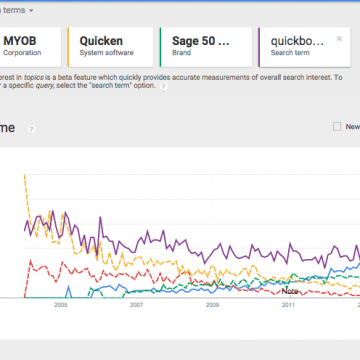

What accounting firms need to understand, is quite simply, the demand is already here and the consumer is often more clued up than the service provider. It is this demand for cloud accounting that has put XERO on the world growth map as one of the leading and fastest growing SME accountancy software firms rapidly swallowing up more and more market share.

When we look at overall consumer behaviour, like a recent study by Internet World Stats and Pew Research Center, Internet penetration is at 87 percent for adults, with 18-29 year olds at 97 percent. Given the connectivity of clients and prospects, it’s unquestionably time for accounting firms to understand what the cloud is all about and take full advantage of its benefits.

So, what is the “cloud” and the future of “cloud accounting”?

Cloud computing technology has soared in popularity over the past 5 years in particular. Just what is the ‘cloud’ and how can it benefit us when it comes to accounting in the cloud – both for the accountant service provider, as well as the SME business owner?

Cloud computing technology has soared in popularity over the past 5 years in particular. Just what is the ‘cloud’ and how can it benefit us when it comes to accounting in the cloud – both for the accountant service provider, as well as the SME business owner?

The ‘cloud’ actually refers to an entire network of computers, servers and data storage that allows a user to access information via the internet from anywhere in the world with internet connection at any time of day. The flexibility is hard to describe without experiencing it. Cloud technology really does mean that so long as you have an internet enabled device (smartphone, tablet, computer etc) you can access files, information, data and so on literally at any time and from any location. Cloud service providers maintain the hardware necessary for digitally storing software and data, allowing users to upload, download and access files 24/7 without limits.

An example of many cloud applications (cloud apps) that we integrate, work with, and have become partners of are listed here: cloud apps.

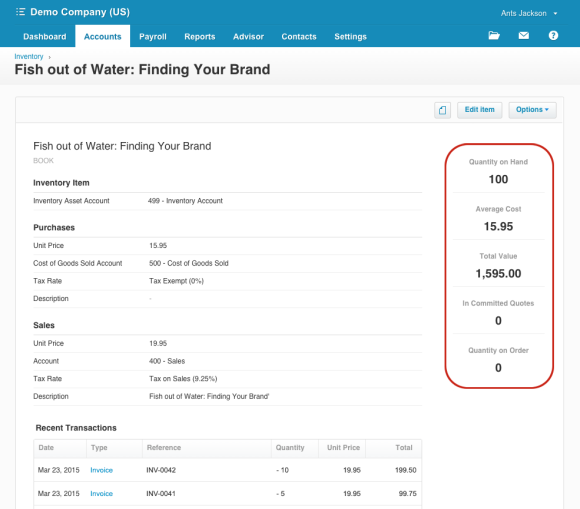

For the tax and accounting profession, cloud services for cloud accounting can mean securely storing accounting, billing and time management software online, and using the cloud to store client data and information safely. But in the accounting world, does the cloud really have advantages over traditional methods? Yes, and there are several reasons why…

Efficiency, Convenience & Flexibility

With information able to be accessed anywhere, from any location literally around the world, from any device, there is no better way to share accounting information between client and accountant. Both the SME business owner enjoys a resulting bonus of greater efficiency due to total flexibility, and so is the accounting practice afforded the same boost – being able to share information between departments and offices with greater speed and flexibility. As a SME business owner having the convenience to log in and see that business data and insights instantly from anywhere is practically imperative to any business success these days.

Cost Saving

Moving to the cloud can save considerable headaches for both the SME business owner, as well as the accounting firm – allowing for streamlining on IT technology costs and training, as well as gross offline software fees being eradicated. Annual maintenance fees can be dispensed with in favour of more affordable monthly pay-as-you go models for cloud applications. Cloud services can also reduce the need for in-house IT staff, as cloud vendors handle server and software maintenance, as well as tech support. Vendors also typically handle system upgrades, which happen automatically, giving you immediate access to updated software.

Time Saving

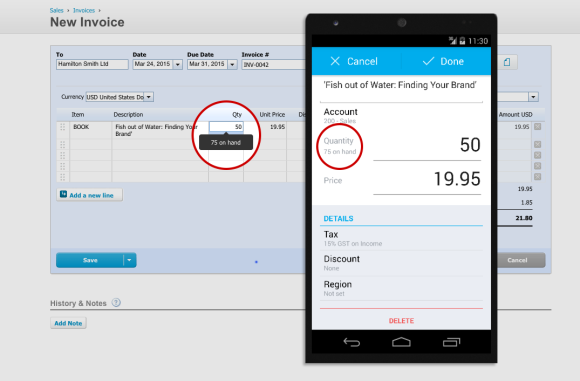

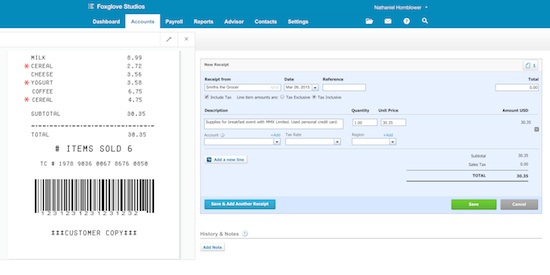

Cloud accounting can seriously reduce time invested by both parties. The SME business owner can eradicate so many lengthy and time consuming tasks, with even the simplest of things such as taking a photograph of receipts using the XERO app to record expenses, all the way up to the software calculating VAT returns, and daily bank reconciliation to keep on top of debtors and so forth. The time saving benefits of cloud accounting are too immense to discuss here, and we will dedicate an entire article to this benefit. Needless to say, the ‘cost’ saving from great efficiency of time investment is critical to the business owner of today.

Reliability & Safety

With the rapid adoption of cloud services and cloud apps in so many industries and sectors has given rise to an explosion of increased focus on data security. Cloud data is typically far more secure these days than data held on your local device such as laptop as it has been by so many people for so many years. Security breaches like those experienced by major retailers, while widely publicised, do not reflect the low possibility that a reputable cloud vendor would be hacked. However, it is important to choose a reputable vendor that has been in the business for at least three to five years. Because it’s a nascent industry, vendors do tend to come and go.

Cloud vendors not only store data in a centralised offsite location, but they often keep copies of your information in one or two other locations for additional backup. The systems are typically self-healing, meaning that if there is a failure at one site you can immediately access the same data via another location.

Expectations

The widespread use of cloud technology in the consumer space is driving its transition across numerous industries—and that includes tax and accounting for cloud accounting service providers. Because consumers, as well as internal staff, are expecting cloud apps and cloud services to be the norm, we feel it is crucial to be at the forefront of leading the cloud accounting revolution in the UK.

The widespread use of cloud technology in the consumer space is driving its transition across numerous industries—and that includes tax and accounting for cloud accounting service providers. Because consumers, as well as internal staff, are expecting cloud apps and cloud services to be the norm, we feel it is crucial to be at the forefront of leading the cloud accounting revolution in the UK.

If you are a SME business owner looking to boost your productivity, efficiency, competitiveness and save money – you should consider our cloud accounting technology and services. Contact us now to discuss how we can help your business grow.