Reclaiming input VAT on the sale of shares

The sale of shares is an exempt supply for VAT purposes, which means that input VAT on professional fees in connection with the

The sale of shares is an exempt supply for VAT purposes, which means that input VAT on professional fees in connection with the

Since April 2014 members of a LLP are no longer automatically treated as self-employed for tax purposes.

Recent Tribunal decisions in favour of employing companies and against HMRC has caused many organisations in similar circumstance to make protective claims for the recovery of National Insurance Contributions (NIC) in respect of car allowances paid to employees using their own cars or vans for business journeys.

The Treasury has announced that the Office of Budget Responsibility (OBR) will produce a report on the state of the UK Economy in time for the Chancellor Jeremy Hunt to present his Autumn Statement on Wednesday 22 November.

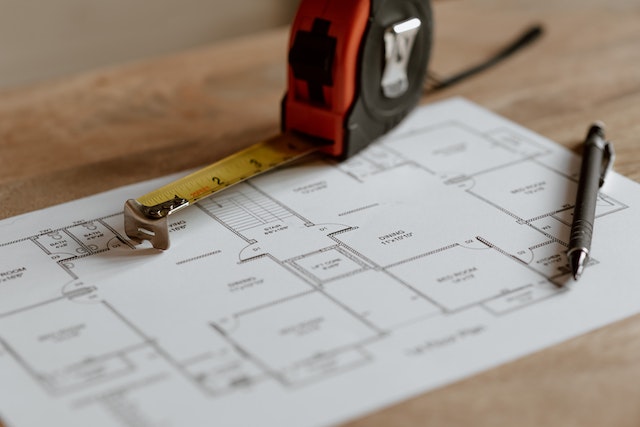

Draft legislation released for consultation on 18 July indicates that business and individual taxpayers will be required to provide more information to HMRC in the next few years.

Currently, where an individual pension holder dies before age 75, drawdown pensions paid to a successor can generally be received free from income tax.

The government have issued draft legislation for consultation on the proposal to merge the two forms of corporation tax relief for expenditure on research and development (R&D)

Parents and carers need to be aware that if either of the couple have ‘adjusted net income’ in excess of £50,000 then the one with the higher income will potentially be charged to tax on some or all of the child benefit and will need to request a self-assessment

The latest Finance Act includes two changes that will affect all R&D claims: (1) a requirement to provide additional information before an R&D claim is made

There are rumours circulating in the press of the possible abolition of inheritance tax (IHT) in a bid by the Government to secure the support of wavering Conservative voters.

HMRC interest rates are linked to the Bank of England base rate. Late payment interest is set at base rate plus 2.5%. Repayment interest is set at base rate minus 1%, with a lower limit – or ‘minimum floor’ – of 0.5%.

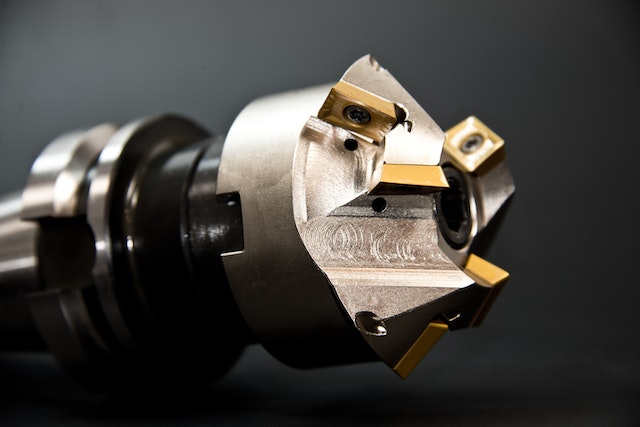

In the Spring Budget the Chancellor announced that “full expensing” – 100% relief for new, eligible plant and machinery – would replace the 130% super-deduction from 1 April 2023

The VAT Flat Rate scheme was introduced in 2002 to simplify VAT reporting for small traders, reducing the time taken to calculate VAT and prepare returns compared to normal VAT accounting.

With all of the changes to personal pensions in the Spring Budget, maximising the State

The HMRC rate of interest on beneficial loans looks very attractive compared to the Bank of England Base rate of 4.5% and much higher rates charged by banks for unsecured loans.

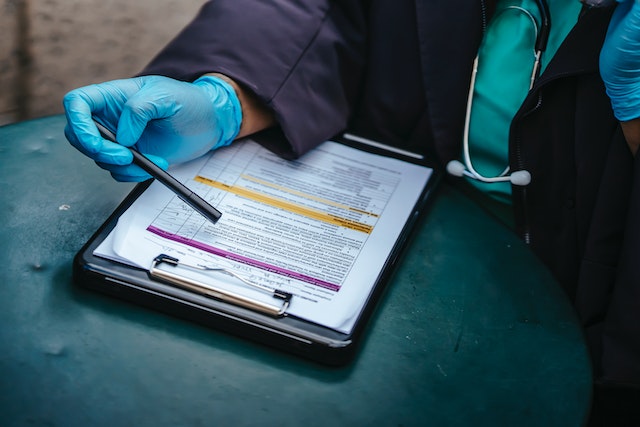

The deadline for reporting shares and securities and share options issued to employees for 2022/23 is 6 July 2023. This is the same as the deadline for reporting expenses and benefits provided to employees on form P11d for 2022/23.

The table below sets out the HMRC advisory fuel rates that apply from 1 June 2023. These are published quarterly these days due to the volatility

HMRC have announced that the official rate of interest will increase from 2% to 2.25% on 6 April 2023

The Government have announced a number of tax consultations on its Tax Administration and Maintenance Day, 27 April. These include measures designed to support the Government’s ambition to simplify and modernise the tax system

The latest Finance Bill will legislate the announcement in the Spring Budget that the Pension lifetime allowance (LTA) charge is abolished from 6 April 2023.

Where benefits in kind are provided to employees that will usually result an income tax charge on the employee and a Class 1A national insurance

The deadline for filing the P11d forms to report benefits in kind in respect of directors and employees for 2022/23 is 6 July 2023.

As well as moving more and more employer returns online HMRC have announced that they will be phasing out paper self-assessment tax returns

Self-employed individuals are required to pay Class 2 and Class 4 NICs if their profits exceed £12,570. These NICs are usually collected with the individual’s income tax self-assessment payments.