Important Tax Deadlines & Events (Updated For 2026)

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

Discover the suggested reimbursement rates for employees’ private mileage using their company car.

Now is the perfect time to review your finances and make sure you’re making the most of available tax reliefs and allowances.

It is that time of year again for staff parties and annual functions, so it is important to make sure you record it properly.

At this time of year, we think about New Year’s resolutions. It is also a good time to start planning your tax affairs before the end of the tax year on 5th April.

When considering the wording of your Will, you should note that the inheritance tax (IHT) nil rate band continues to be frozen at £325,000, subject to any announcements in the Spring Budget.

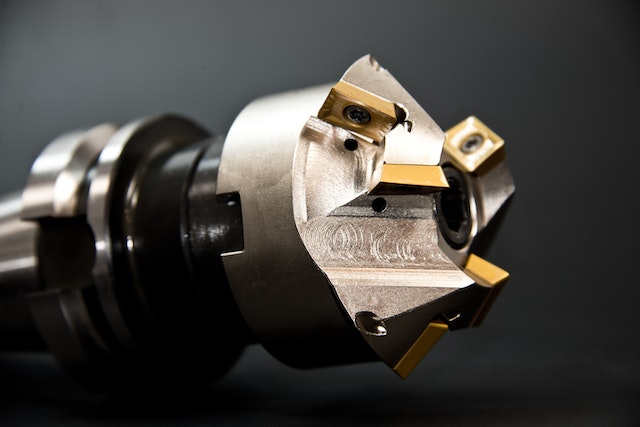

The Annual Investment Allowance (AIA) is now permanently set at £1million. This means that businesses can claim tax relief at 100% on up to £1million of expenditure on qualifying plant and machinery (e.g. capital equipment).

The biggest ever increase to the National Living Wage has been announced, with the government fully accepting the recommendations made by the Low Pay Commission. Eligibility for the

In recent years many accountants have advised their director/shareholder clients that the most tax efficient method of extracting profit from their family company was to pay themselves a low salary, at or around the £12,570 personal allowance, with the balance in dividends.

HMRC have recently clarified their view of the tax treatment of the reimbursement of electricity costs where employees charge their electric company cars at home. HMRC now accepts that reimbursing part of a domestic energy bill, which is used to charge a company car or van, is exempt from income tax. Their previous view was that such reimbursements were taxable.

The sale of shares is an exempt supply for VAT purposes, which means that input VAT on professional fees in connection with the

Since April 2014 members of a LLP are no longer automatically treated as self-employed for tax purposes.

Employers investing in new vans will be rewarded for choosing zero-emission models. Not only will employees be able to use the vans privately without having to pay tax on the benefit, there will be no Class 1A National Insurance for the employer to pay either.

Recent Tribunal decisions in favour of employing companies and against HMRC has caused many organisations in similar circumstance to make protective claims for the recovery of National Insurance Contributions (NIC) in respect of car allowances paid to employees using their own cars or vans for business journeys.

In order that we can help predict your taxable profits and tax liabilities we need up to date profit figures and projections.

Currently, where an individual pension holder dies before age 75, drawdown pensions paid to a successor can generally be received free from income tax.

The government have issued draft legislation for consultation on the proposal to merge the two forms of corporation tax relief for expenditure on research and development (R&D)

Parents and carers need to be aware that if either of the couple have ‘adjusted net income’ in excess of £50,000 then the one with the higher income will potentially be charged to tax on some or all of the child benefit and will need to request a self-assessment

The latest Finance Act includes two changes that will affect all R&D claims: (1) a requirement to provide additional information before an R&D claim is made

In the Spring Budget the Chancellor announced that “full expensing” – 100% relief for new, eligible plant and machinery – would replace the 130% super-deduction from 1 April 2023

The VAT Flat Rate scheme was introduced in 2002 to simplify VAT reporting for small traders, reducing the time taken to calculate VAT and prepare returns compared to normal VAT accounting.

With all of the changes to personal pensions in the Spring Budget, maximising the State

The HMRC rate of interest on beneficial loans looks very attractive compared to the Bank of England Base rate of 4.5% and much higher rates charged by banks for unsecured loans.

The table below sets out the HMRC advisory fuel rates that apply from 1 June 2023. These are published quarterly these days due to the volatility

HMRC have announced that the official rate of interest will increase from 2% to 2.25% on 6 April 2023